What is the first step in finding a contractor? It’s good to start your search with “word…

Watch VideoThe Latest Legal Developments in PA and NJ

We have our fingers on the pulse of the latest legal news, rulings, and regulations in Pennsylvania and New Jersey. Explore our free resources to stay up to date on the developments impacting your personal and business lives.

Resources

The Applicability of the Americans with Disability Act to Short Term Rental Facilities

The Covid-19 Pandemic has changed our world as we know it. One of the most significant changes…

Read MoreGetting Your Business Off the Ground: How a Business Formation Attorney Can Help

While the pandemic forced hundreds of thousands of small businesses to close throughout the United States, it…

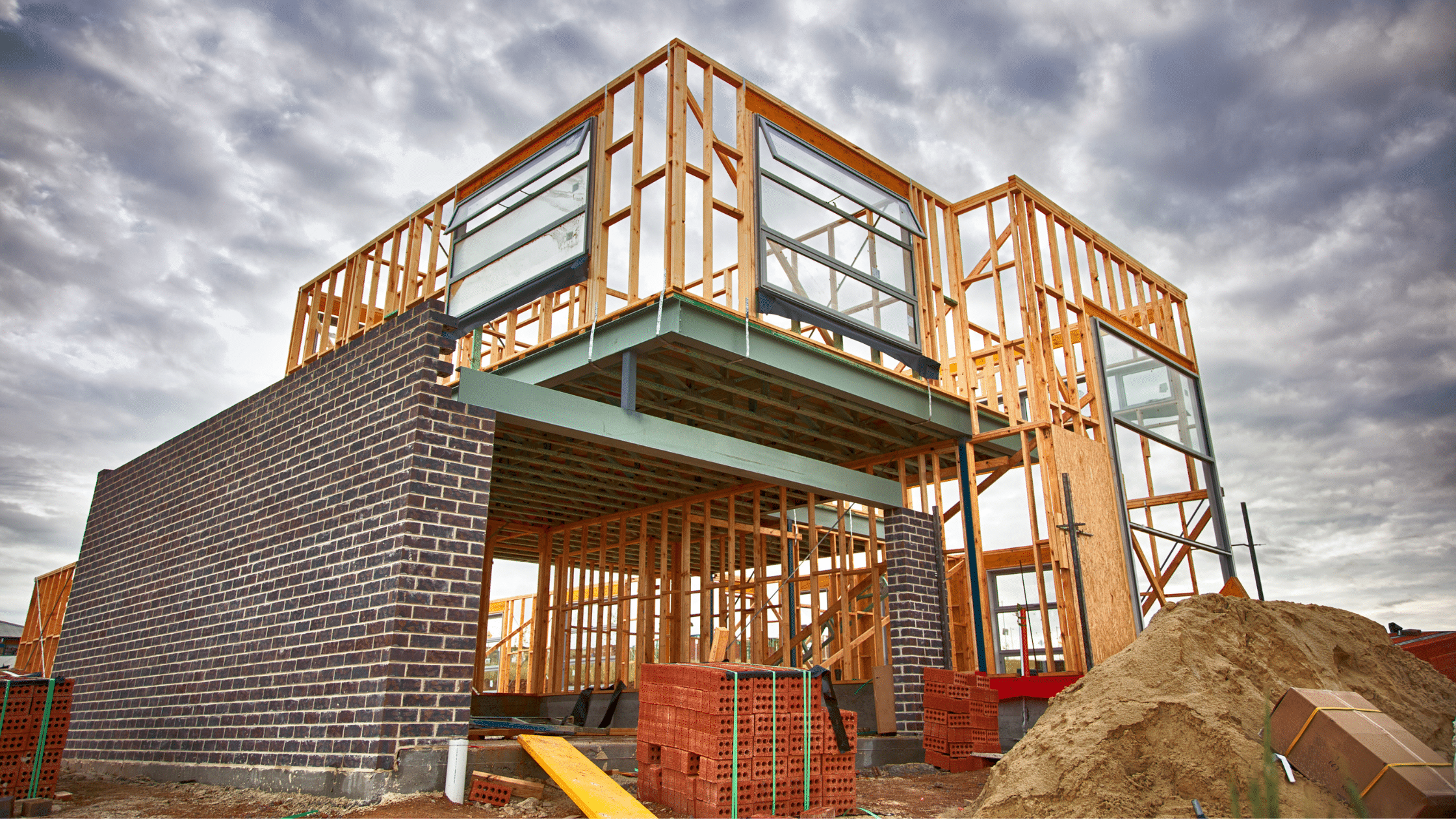

Read MoreThe Most Common Causes of Construction Litigation

Construction litigation can be quite complex due to the high number of parties and numerous moving parts involved. This creates several opportunities for issues to arise that can quickly skew the project’s deadline or halt the production altogether.

Read MoreIn the Zone with Clementa Amazan – Episode 2

What is the Green Roof Bonus? In our premiere episode of In the Zone with Clementa Amazan,…

Watch VideoLandlord’s Termination of Lease Overrides Tenant’s First Right of Refusal Claim

One of the most prevalent of such contractual rights is known as a first right of refusal….

Read MoreNatalie Klyashtorny Named Shareholder of Nochumson P.C.

Natalie represents individuals, professionals, real estate developers, and investors, and small to medium-sized businesses (SMBs) in commercial…

Read MoreIt’s Always Zoning in Philadelphia

Philadelphia may be an old city, but as one travels through many of the city’s neighborhoods, one…

Read MoreCourt: Plaintiffs Carry Burden of Proof in Property Damage Cases

In Roberts, Elisabetta Roberts owned a townhome adjacent to a property purchased and demolished by Lily Development, the…

Read MoreDifferences Between Gross Lease and Net Lease

One of the most attractive aspects of commercial real estate is the ability to negotiate and structure…

Read More