Differences Between Gross Lease and Net Lease

One of the most attractive aspects of commercial real estate is the ability to negotiate and structure deals in any way that fits certain criteria....

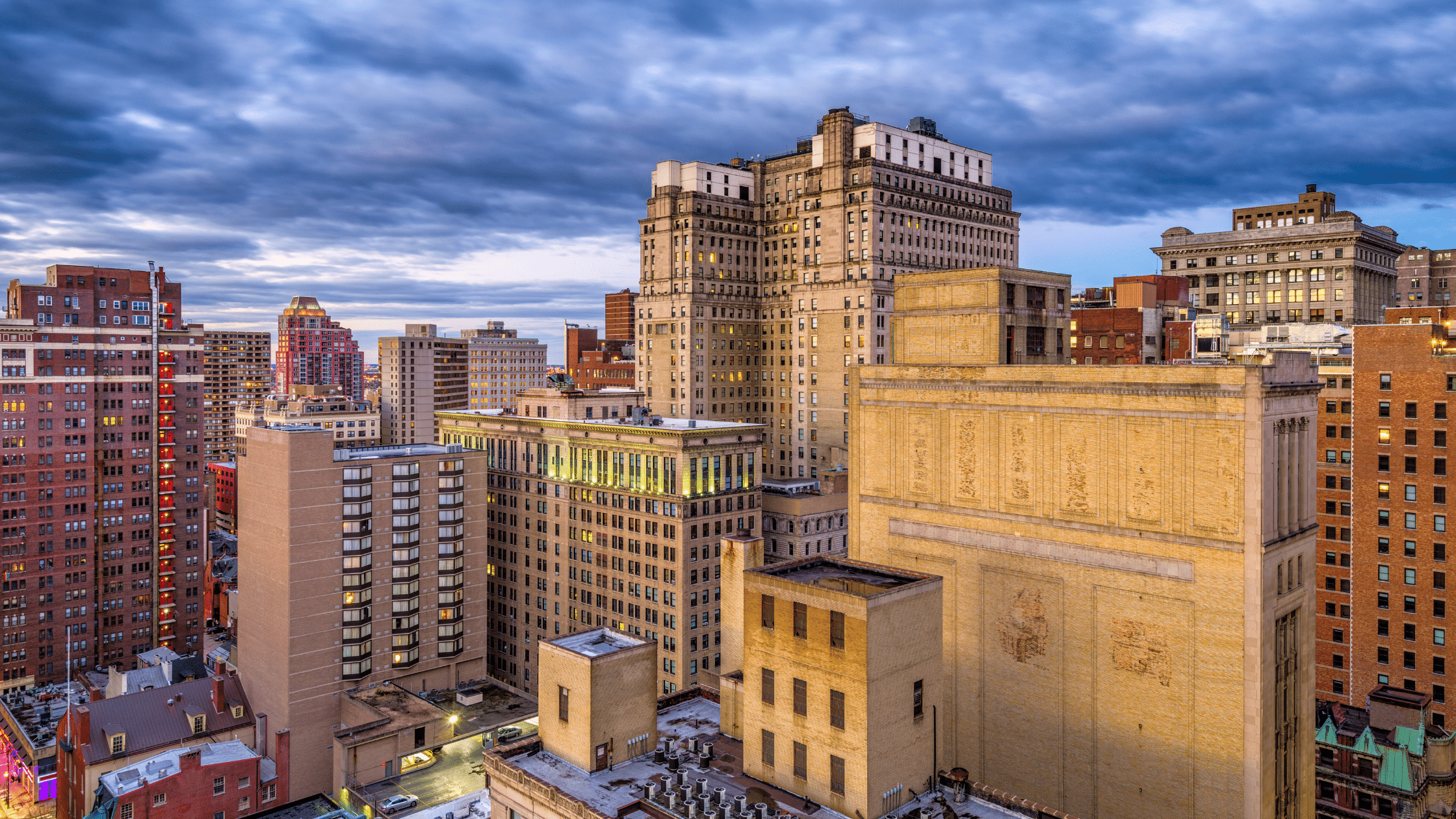

When entering into a new commercial lease agreement for your business, many different factors can influence the decision-making process. From obvious financial factors to slightly more esoteric considerations like space layout and functionality, a commercial lease is capable of shaping the direction and success of your company. Commercial leases tend to be more complex than residential leases, so it is important to carefully research the terms of a commercial lease before signing. Because leasing commercial space is often the largest expense for a business, understanding the risks and benefits of various types of commercial leases is extremely important. Being familiar with typical commercial lease terms and clauses can help make the process less stressful.

With so many different types of businesses and industries looking for commercial space, there are also a variety of commercial lease agreements to choose from. At first glance they may seem to be very similar, however, it is important to fully grasp the sometimes subtle variances between the different types. While certain financial and property-related responsibilities could fall to either the landlord or tenant depending on the agreement, it is important for a business owner to identify which agreement will best serve their business going forward. Below are the 4 most typical commercial lease agreements:

One of the most important, and often overlooked, aspects of typical commercial lease terms are the clauses they contain. While it is always recommended to have an attorney review the agreement for such an important decision, having a basic understanding of the clauses involved can be the difference between a space and an agreement that suits your particular needs well and one that can quickly become claustrophobic, constraining, and expensive. Below are three of the most common clauses that you should know:

At Nochumson P.C., we are more than legal counsel. We are people serving our neighbors and community in Pennsylvania and New Jersey. Knowing that real communication between real people can help lead to real positive results, our team of attorneys are available 24/7 to help answer your legal questions and to fight for you with skill and fortitude, whatever the case may be. When you hire us, you can expect a sensible and cost-effective approach to legal counsel. We think fast, think ahead, and get things done. Contact us today or call us at (215) 399-1346 to see how we can represent you.

One of the most attractive aspects of commercial real estate is the ability to negotiate and structure deals in any way that fits certain criteria....

Of particular importance is that, under Pennsylvania law, an amendment or assignment of a commercial lease through its mere execution extinguishes...

Most significantly, the 10-year tax abatement on residential new construction, which was previously scheduled to be significantly altered beginning...